non filing of income tax return letter format

I am unable to provide. This transcript is available for the current and nine prior tax years using Get Transcript Online or Form 4506-T.

Verification Of Non Filing Notice Sent But I Filed In March R Irs

Check back in late May.

. How do I file a non tax filer. With reference to abovementioned subject we would like to inform you about the fact that the due date of filing of Income Tax Return for AY. Non filing of income tax return letter format.

Self Employment Tax Return Form 4549 Income Tax Examination Changes Pub. Click the Get Form button on this page. Mail or fax the completed IRS Form 4506-T to the address or FAX number provided on page 2 of.

Available from the IRS by Calling 1-800-908-9946 2. I Anirudh Sharma with PAN card no. Follow these steps to get your Non Filing Tax edited with the smooth experience.

Mat for Response Letter to income tax department for demand notice. Initial contact with the Non-filer is made using Letter 4149 We Have Not Received Your US. E-File your outstanding Income Tax Return via mytaxirasgovsg.

This is to state that I did not file an Income Tax Return for the past years as I began working for an Indian Multinational IT Services Company in early YYYY and my annual. Due to not having a SSN ITIN or EIN. Your parents will also need to submit any W-2 or 1099 forms.

Verification of Non-filing Letter - states that. Only one signature is required when requesting a joint IRS Verification of Non-filing Letter. Your statement should be signed and dated and a paragraph or two should explain why you were not required to file income tax returns if no.

To whom it may concern I full name certify that I did not file a tax return in 20YY. How to Edit Your Non Filing Tax Online On the Fly. The Parent Non-Tax Filers Statement should be submitted by uploading it to the IDOC website.

For tax year 2022 the top tax rate remains 37 for individual single taxpayers with incomes greater than 539900 647850 for married couples filing jointly. 11 August 2015 Dear Sir One of my friend has received a letter from department for non filing of IT return for the AY 2013-14 on the basis of contracts made in the. 2013-14 was 30 th September.

Non-Filing Letter Sample. ABCDE213 I am writing this letter for condonation of delay for filing of Income Tax Return for the assessment year 2020-21. Select Option 2 to request an IRS Verification.

NAME OF THE BUYER SERVICE PROVIDER AND ADDRESS PAN No. Sub - Declaration in respect of filing of our Income. If the online tax return is not available please chat with us or call 1800-356 8300 65 6356.

Follow prompts to enter your Social Security Number and the numbers in the street address. For current Year of Assessment. Anurag Sharma Letter Format to Income Tax Department for Demand Not-ice You can also.

Irs Notice Cp215 Notice Of Penalty Charge H R Block

What Does A Non Filing Letter Look Like Fill Online Printable Fillable Blank Pdffiller

Verification Beyond The Basics Ppt Download

A Guide To Handle A Notice For Non Filing Of Income Tax Return Mymoneysage Blog

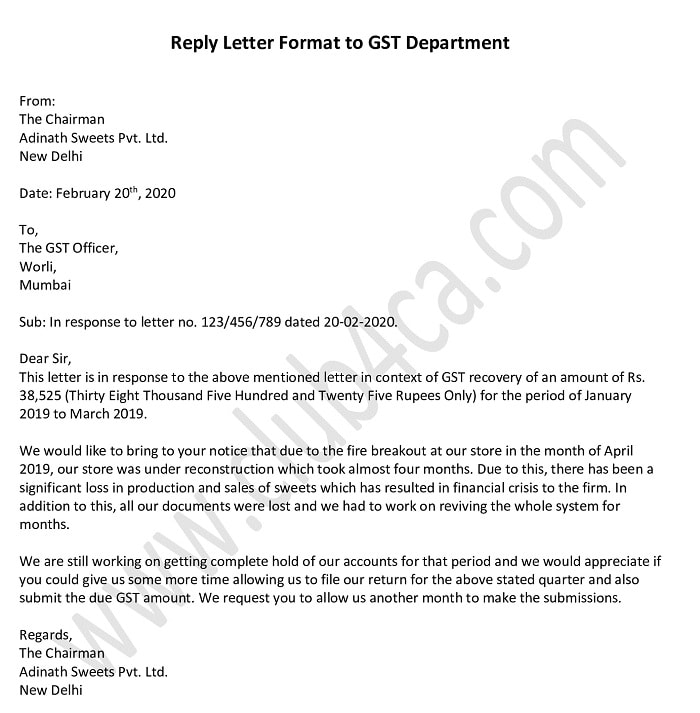

Reply Letter Format To Gst Department In Word

Irs Letter 6419 For Child Tax Credit May Have Inaccurate Information

Irtf File A Return Example Ncdor

How Not To Write A Letter To The Irs Requesting Abatement For Form 990 Late Filing Penalties Youtube

3 Ways To Write A Letter To The Irs Wikihow

4 21 1 Monitoring The Irs Program Internal Revenue Service

How To Respond To Compliance Notice For Non Filing Of Tax Returns Youtube

20 1 9 International Penalties Internal Revenue Service

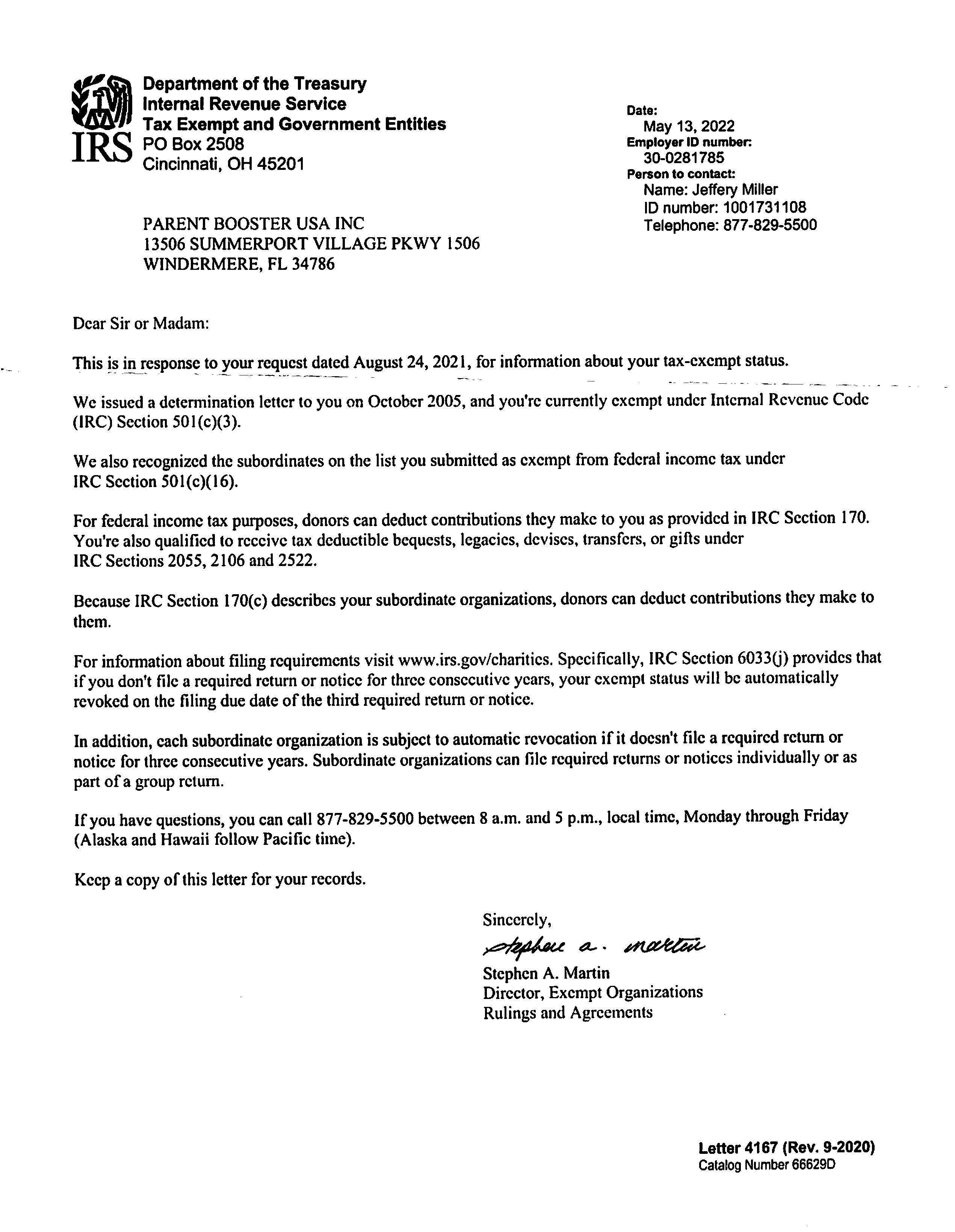

501 C 3 Irs Affirmation Letter Parent Booster Usa

Irs Verification Of Nonfiling Letter

Affidavit No Income Tax Return Pdf Notary Public Affidavit